What happens if you get in a car accident involving Uber, Lyft, DoorDash, Grubhub, or Uber Eats?

Rideshare Companies (Uber and Lyft)

The million-dollar question, well, in this case, the one-and-a-half-million-dollar question is, can I sue a rideshare company such as Uber or Lyft if the accident was caused by one of their drivers? Well, depending on whether one of these apps was in use at the time of the accident, there may be $1,500,000 available in insurance coverage, along with other favorable conditions regarding New Jersey’s verbal threshold/limitation on lawsuit.

In 2016, New Jersey passed a new law called the “Transportation Network Company Safety and Regulatory Act,” codified at N.J.S.A. 39:5H-1 et seq. The new law, in part, defines “Transportation Network Company” as a “corporation, partnership, sole proprietorship, or other entity that is registered as a business in the State or operates in this State, and uses a digital network to connect a transportation network company rider to a transportation network company driver to provide a prearranged ride.” N.J.S.A. 39:5H-2.

The statute likewise defines a “prearranged ride” and in part provides that the “provision of transportation by a transportation network company driver to a transportation network company rider, beginning when a driver accepts a ride requested by a rider through a digital network controlled by a transportation network company, continuing while the driver transports a requesting rider, and ending when the last requesting rider departs from the personal vehicle.”Id.

In simpler terms, the statute prescribes that a “ride” begins as soon as the driver accepts the request from the app, meaning before the driver has even driven to pick up the passenger(s). As demonstrated by the examples at the end of this section, this has significant meaning, as the acceptance triggers mandatory insurance coverage from Uber and Lyft.

Insurance Requirements for Uber and Lyft

Under the Transportation Network Company Safety and Regulatory Act, there are different requirements for minimum coverage depending on whether a driver has accepted a ride, is merely logged into the app, or whether the driver is logged off or inactive.

Accepted A Ride

If the driver has accepted a passenger, the following insurance is available:

- Liability insurance of at least $1,500,000 for death, bodily injury, and property damage;

- Primary insurance for medical payments in an amount of at least $10,000 per person/per accident (only available for the driver); and

- Underinsured (UIM) and uninsured (UM) motorist coverage of at least $1,500,000.

Waiting To Accept A Ride

If the driver is logged into the app but has not yet matched with a passenger, Uber or Lyft must provide at least the following coverage:

- Liability insurance of at least $50,000 for death or injury per person/$100,000 for death or bodily injury per accident, and $25,000 for property damage;

- Primary insurance for medical payments in an amount as required by N.J.S.A. 39:6A-4; and

- Underinsured (UIM) and uninsured (UM) motorist coverage as required under N.J.S.A. 17:28-1.1.

Logged Off/Inactive

If the driver has not logged into the app or is inactive, their personal car insurance will apply.

Verbal Threshold/Limitation on Lawsuit

In addition to the above insurance coverage, Uber and Lyft cannot raise the verbal threshold or limitation on lawsuit defense, even if the injured individual has selected this option on their insurance policy. This means that an injured individual will not have to prove a permanent injury to sue for pain and suffering.

Frequently Asked Questions and Examples

-

Can I sue the Uber or Lyft driver if he was at fault?

Pursuant to N.J.S.A. 39:5H-12, insurance companies may exclude all coverage for a private passenger vehicle, and therefore the Uber or Lyft driver’s personal insurance likely will disclaim coverage for the accident. As such, Uber or Lyft is required to provide $1,500,000 in liability coverage.

-

I was a passenger in an Uber/Lyft, and the Uber/Lyft driver was at fault, who do I sue?

If the Uber or Lyft driver was at fault for the accident, New Jersey law requires that Uber/Lyft provide $1,500,000 in liability coverage for death, bodily injury, and property damage. Additionally, Uber/Lyft cannot raise the verbal threshold/limitation on lawsuit defense.

-

I was hit by an Uber or Lyft driver while he was driving a passenger or on his way to pick up a passenger, what coverage is available?

If you are operating a motor vehicle or were a pedestrian, and an Uber or Lyft driver hit you, Uber/Lyft is required to provide $1,500,000 in liability coverage for death, bodily injury, and property damage. Further, Uber/Lyft cannot raise the verbal threshold/limitation on lawsuit defense.

-

I was hit by an Uber or Lyft driver, but he wasn’t driving a passenger at the time of the crash, what coverage is available?

Under New Jersey law, if the Uber/Lyft driver was responsible for the accident but was not carrying a passenger at the time or driving to pick up a passenger, the Uber/Lyft driver’s own insurance will be all that is available. This is often significantly less than the $1,500,000. Conversely, if the Uber/Lyft driver had accepted a passenger and was on their way to pick up the passenger when the crash occurred, the $1,500,000 in coverage is triggered. Lastly, if the Uber/Lyft driver was merely logged into the app at the time of the crash but had not yet accepted a passenger through the app, the $50,000/$100,000 minimums apply.

-

I was a passenger in an Uber/Lyft, but the other car was at fault, who do I sue?

If the Uber or Lyft driver were not at fault for the accident, you would sue the other driver. However, New Jersey law requires ridesharing companies to provide $1,500,000 in uninsured (UM) and underinsured (UIM) benefits. Therefore, if the other at-fault driver either does not have insurance or has insufficient insurance to cover your damages, you can look to Uber or Lyft to pick up the rest.

-

I was a passenger in an Uber or Lyft, but I was not wearing my seatbelt, what are the consequences?

While we all know it is unsafe to do so, the simple fact of the matter remains that we often jump in an Uber or Lyft for a short drive and fail to buckle our safety belt. In New Jersey, you can still sue for your injuries, even if you were not wearing a seat belt. However, if the defendant has an expert who says your injuries are worse because you were not wearing a seat belt, your damages may be reduced accordingly.

-

I was an Uber or Lyft driver, and another car crashed into me, what insurance is available?

You would first look to the negligent driver’s insurance. But if the other driver does not have insurance or has a minimal policy, Uber/Lyft is required to provide you with $1,500,000 in uninsured (UM) or underinsured (UIM) benefits.

-

What happens if the Uber or Lyft driver was at fault but did not have his own insurance?

If your Uber/Lyft driver does not have insurance or let the policy lapse, the situation is tantamount to the situation where they did have insurance. The driver’s own insurance company may likely have disclaimed coverage pursuant to N.J.S.A. 39:5H-12, and you would pursue the $1,500,000 in liability coverage from Uber/Lyft.

-

Do Uber and Lyft retain their data from the ride?

Uber and Lyft have entered into a “memorandum of understanding” with the state Department of Transportation, “concerning the transportation network company’s submission of data collected from prearranged rides.” However, any data submitted to the Department of Transportation is deemed confidential and will not be disclosed to a third party without the prior written consent of Uber or Lyft. Therefore, the data is not accessible through the state’s Open Public Record Act (OPRA), and the state only may use the data to better understand traffic patterns to aid in designing better roads with less traffic.

Food Delivery Companies (DoorDash, Grubhub, Uber Eats)

Unlike Uber and Lyft, food delivery companies such as DoorDash, Grubhub, and Uber Eats, are not considered “transportation network companies” and are therefore are not subject to the Transportation Network Company Safety and Regulatory Act, nor its requirements of insurance minimums. In fact, New Jersey law does not require food delivery companies to provide their drivers with additional insurance. Nevertheless, many of the food delivery companies still offer coverage.

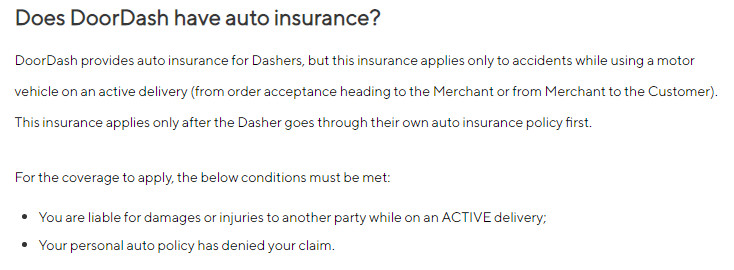

DoorDash

DoorDash provides a $1,000,000 contingent liability policy “when you are in possession of goods to be delivered.” This means, unlike rideshare companies where full coverage kicks in when a ride is accepted, DoorDash only provides coverage from the restaurant to the customer’s door, not driving to the restaurant. Additionally, this coverage is secondary to your own insurance policy. More information regarding DoorDash’s insurance can be found on their website.

Grubhub

Unlike DoorDash, Grubhub does not provide any additional insurance for its drivers. They instead require drivers to carry their own auto insurance.

Uber Eats

UberEats provides $50,000 in bodily injury liability per person and $100,000 per accident, along with $25,000 in property damage coverage while the app is on and a driver is awaiting a request. If the driver has accepted a pick-up, the coverage increases to $1,000,000 in liability coverage. Additionally, as New Jersey law requires personal injury protection (PIP) and uninsured motorist (UM) coverage, Uber Eats will provide this insurance. However, it is unclear at the moment what these minimums would be.

Rideshare Insurance

As not all personal car insurance policies will cover you when you deliver or pick up a passenger, it is vital that you check with your insurance company before you begin working for Uber, Lyft, DoorDash, Grubhub, or Uber Eats. Some insurance policies will automatically include rideshare options. Still, it is important that you contact your insurance agent before an accident and before you begin driving for any of these or similar companies to ensure you are covered if you are involved in an accident.

Conclusion

If you have been injured as a result of the negligence of a Uber, Lyft, DoorDash, Grubhub, or Uber Eats driver in New Jersey, and you wish to discuss your legal options, Farrell & Thurman, P.C., offers a variety of convenient ways to schedule a free, no-pressure consultation. You may do so directly on our website (Schedule A Consult), via phone (609-924-1115), or by email (Contact Us).