New Jersey Car Accident Settlement Process, Timeline, and Frequently Asked Questions

What is a good settlement offer, and will I get more money if I hire a personal injury lawyer?

A good settlement offer is as much as you can get, and that is best achieved by hiring a personal injury lawyer. In fact, a study conducted by the Insurance Research Council indicated that people who have suffered bodily injuries in a car accident win 3.5 times more in settlement money than those who did not hire a personal injury attorney. The study additionally found that in eighty-five percent (85%) of cases where an insurance company settled an injury claim, the injured individual had hired an attorney.

Consequently, it is often prudent to consider hiring an attorney who will know not only the procedural requirements of filing and pursuing a claim but will also know the tactics of the insurance companies involved. Further, a personal injury attorney knows how to calculate pain and suffering accurately and what other special damages, such as punitive or treble damages, may be available. A lawyer will also have experience assessing long-term effects of injuries and what future care may be needed, something unrepresented individuals often fail to consider.

How much should I get for a car accident settlement?

Probably the most frequently asked question of potential personal injury plaintiffs is, how much can I get for my car accident settlement? Well, to be candid, it is tough to estimate how much your injuries are worth before a full investigation of the claim. Factors such as prior injuries or accidents, whether the injured party caused a portion of the accident, and whether new injuries are objectively confirmable through diagnostic testing (MRIs, EMGs, X-rays, CAT scans, etc.) or other means are directly resultant from the subject accident, make answering this question a moving target early in the case.

Nevertheless, insurance companies often employ a formula to determine how much they are willing to pay. This formula typically consists of totaling the economic damages (medical bills, lost wages, property damage, etc.) and multiplying that number by one (1) through five (5), depending on the severity of the injury.

For example, let’s say you were in a rear-end car accident, wherein you injured your back. The medical bills concerning your treatment total $35,000, you lost $15,000 in wages since you were unable to work due to your back pain, and you had to receive a minor surgery to alleviate the pain. The insurance company may then determine a multiplier of 2, based upon prior degeneration of the back, in which case your total settlement would be $150,000 ($50,000 in economic damages ($35,000 plus $15,000 for medical bills and lost income), plus $100,000 in non-economic damages ($50,000 multiplied by 2)).

While the above is intended only as an example, in practice, there are additional considerations such as partial fault and the opinions of the opposing doctors, who may opine that the surgery was unneeded or that the injuries were pre-existing. For these reasons, it is imperative that you hire an experienced lawyer.

How long does it take to settle a car accident lawsuit in New Jersey?

Another common question of potential personal injury plaintiffs is how long will the claim process take? While this question again is often a moving target and will depend on the specific claim, most car accident cases are settled within two (2) years.

However, several factors can act to either shorten or lengthen that timeline. For instance, the length of an injured individual’s treatment will significantly affect the length of the claim. An attorney will often have to wait for your treatment to conclude so that all necessary treatment records can be obtained and the severity of the injuries can be assessed. Therefore, if you undergo six (6) months of chiropractic treatment, an attorney will typically wait until you finish treatment to begin negotiation, as they will require the complete picture to make a case to the insurance company.

Another driving factor is how vehemently the insurance company wishes to fight your claim and who the insurance company is. Several insurance companies, for example, have gained reputations for playing “hardball” in an attempt to weed out frivolous claims, hoping that minor claims won’t waste their time if they see a particularly hard insurance company insures the at-fault driver. There are also companies that are seen as paying any claim. However, these companies typically issue small policies and understand that fighting the claim will cost them more than the policy in legal fees.

Again, an experienced attorney will often have prior experience dealing with the insurance company to which your claim is being opened and will know their specific tactics.

How long does an accident stay on my insurance?

Insurance companies often have different factors that they consider when determining your rates. Factors such as speeding tickets, past at-fault accidents, etc., will have a negative effect. However, things such as a minor fender bender or a minor ticket may or may not affect your rate at all. Nevertheless, most insurance companies consider a three (3) to five (5) year history, meaning if you had an at-fault accident six (6) years ago, it is likely not to be considered at all.

What is the average car accident settlement in New Jersey?

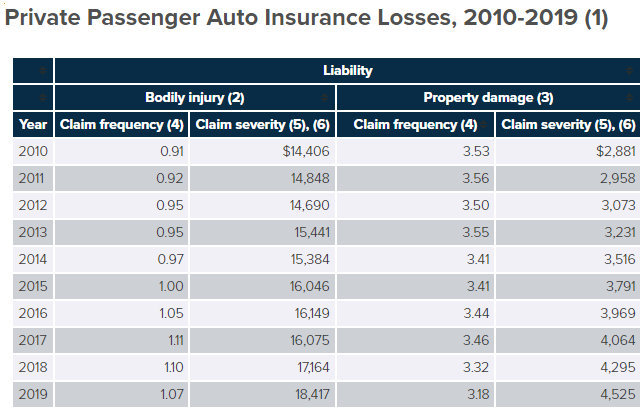

While every claim is different, and claims involving surgeries often result in settlements over $100,000, according to the Insurance Information Institute, the average car accident settlement in the United States for 2019 was $18,417. However, keep in mind that the laws differ dramatically from state to state, which can result in some states seeing much higher settlements, and others much lower.

Is settlement money from a car accident taxable?

Generally, you will not need to pay any taxes on your auto accident injury settlement. There are some instances where the money can become taxable, however. For example, if you took an itemized deduction for medical expenses related to the injury in the prior year(s), you must include in income that portion of the settlement. Additionally, if a portion of the settlement was for lost wages, these proceeds are subject to employment tax and should be reported as wages, salaries, tips, etc.

For a more detailed explanation, the Internal Revenue Service has published a two (2) page document regarding the taxability of settlements. Additionally, you should consult a tax professional for specific questions.

What should I do with a large settlement check?

As stated above, settlement money is not taxable for the most part. However, you should still determine what portion, if any, of your settlement is taxable. After that, you should create a plan for your settlement.

Pay Down Debts

By using your funds to pay what you may owe from credit cards, high-interest loans, bills, or the principal on your home, you may earn financial freedom.

Create an Emergency Fund

After paying down debts, you should try to set aside about six (6) months of living expenses to prepare for sudden emergencies or expenses. This will be your best defense against incurring future debts.

Purchase or Improve Your Home

If you don’t already own your home, your settlement money may be an opportunity to make a sizable down payment on a new home or to improve your home. Improvements such as redoing your kitchen often can lead to significant appreciation of your home’s value.

Save for Retirement

Another smart decision could be to set aside a portion of your settlement money for retirement. You should consider taking advantage of the opportunity to save some money for the years ahead and to retire comfortably.

Make or Update Your Estate Plan

If you don’t already have a will, you should consider hiring an estate attorney to create a plan for what happens to your assets after you’ve passed. If you have a will, you should consider how much has changed and whether the will should be revised.

Splurge

Although probably not the wisest way to spend your money, it is your money, and the memories of a family vacation or the purchase of a dream item may be invaluable to you. However, try to avoid rash decisions, bank pitches, get-rich-quick schemes, and lending too much to friends and family.

Do always keep in mind that the general belief is that approximately seventy percent (70%) of lottery winners go bankrupt within three (3) to five (5) years.

Conclusion

If you have been injured in a New Jersey car accident that was not your fault, and you wish to discuss your legal options, Farrell & Thurman, P.C., offers a variety of convenient ways to schedule a free, no-pressure consultation. You may do so directly on our website (Schedule A Consult), via phone (609-924-1115), or by email (Contact Us).